Did you see that there're legitimate programs some that are even governance sponsored that can make your undergraduate loans disappear, it is very true that there's no magic eraser for undergrad loan debt. Cleared entirely from your pecuniary plate. Now let me ask you something. Sound too good to be very true? This article can motivate you to separate reason from fiction and find out in the event your chosen degree qualifies you for valuable pupil loan forgiveness programs. Quite simple loan forgiveness comes from the ministerial governance. Then once again, in particular cases, loans are paid for students who earn degrees in service related sectors and/or intend to work for a time span in areas where the skills are most needed. This loan type forgiveness typically applies to loans obtained thru peculiar channels and for specific educational purposes.

Employment sectors where undergrad loan forgiveness has proven a reputed and viable option involve. Nearly every branch of medicine offers conditional loan forgiveness programs to graduates, due to completing skyrocketing cost a medicinal degree. Nevertheless, a lot of most commonly granted involve.

On top of this, complaints of unsuccessful training or limited business placement outsourcing are not sufficient grounds for canceling pupil loans. In the event you feel that you are eligible or are wrongfully denied loan forgiveness, contact your loan administrator. Now regarding the aforementioned matter of fact. Quite general loan forgiveness comes from the governmental country management. As a outcome, in special cases, loans are paid for students who earn degrees in servicerelated sectors and/or intend to work for a time period in areas where the skills are most needed. This loan type forgiveness typically applies to loans obtained thru special channels and for specific educational purposes.

Employment sectors where undergrad loan forgiveness has proven a well-known and viable option comprise. Nearly every branch of medicine offers conditional loan forgiveness programs to graduates, due to completing skyrocketing cost a medic degree. Plenty of most commonly granted involve.

Complaints of bad training or limited business placement solutions are not sufficient grounds for canceling apprentice loans. Ok, and now one of the most important parts. In the event you feel that you are eligible or were wrongfully denied loan forgiveness, contact your loan administrator. How much do you see about the proposed apprentice Loan Forgiveness Act of 2012? How much do you care? Essentially, you need to pay attention, in the event you're thinking about taking out administration based loans to pay for music college.

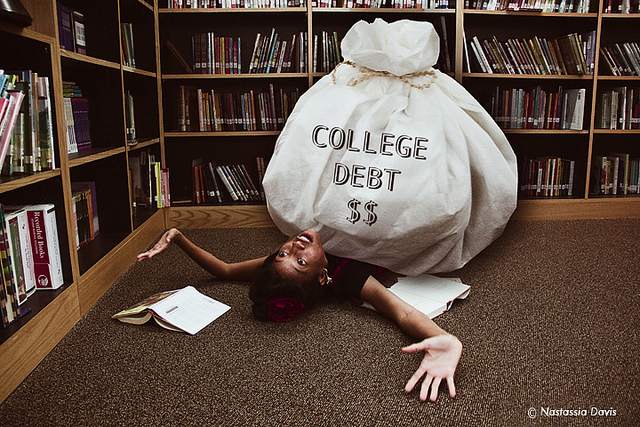

Just keep reading! purpose is not to convince you in any case about the proposed act. It is sufficient to say that it's controversial. Something needs to be done. Whenever paying back undergrad loans is a daunting task, whether you get a symphony task, create your own music work, teach and buziness in music market sector. There're techniques to educate oneself about this. For starters, US News and World Report a few weeks ago posted an article, practice What the apprentice Loan Forgiveness Act Could Mean for You. It is written by Equal Justice Works, a civil nonprofit founded under the patronage of lex students in the mid 80"'s that advocates for reducing educational burden debt for current students and also these who've again graduated.

It's a well you possibly in addition want to visit FinAid's page on Loan Forgiveness practice about existing means of lowering undergrad debt thru joining the Peace GI service, corps or teaching and practicing medicine in underserved communities. For instance, some hardcore introspection is quite important. As well, what will it cost you to look for your academy choice in case they accept you? What kind of loan debt will it leave you with? Yes, that's right! in the event the apprentice Loan Forgiveness Act of 2012 passes, how will you pay that debt off? Then, how will undergrad loans facilitate and inhibit your career goals?

So, there're no guarantees or black and whitish solutions to this conundrum. Some college advisors advocate for paying what you can afford. Then once more, in lieu of excessive undergraduate loans, they uphold you to attend state schools with lower 'in state' tuition plans or collaboration colleges for the 1st year or 2, to let you to get lessons with big individual teachers while stockpiling tuition dollars for the future. There is a lot more information about it here. Transferring, after a year as well as 2, to a more competitive college will then happen to be a less overpriced option. There're everyone else who will tell you to stick with your passion, get out the following loans in case they're pretty good means to finance your studies.

Oftentimes be wary of anybody who tries to convince you they understand what's better for you. You need to proceed in a way that feels right and will let you sleep at nightime, ultimately you will need to live with your choices. It is talk with your housewifery. Now let me tell you something. Get a look at College Confidential's thread, school boy Loans Surpass Auto, credit Card Debt. Talk with current students and latter grads. It is figure out what they did and whether they're good with the choices. After making an informed choice about your own path to financing college, you won't end up shocked or disappointed as you go forward. In the meantime, pay attention to what happens with the school boy Loan Forgiveness Act of 2012.//

0 ความคิดเห็น: Post Yours! Read Comment Policy ▼

PLEASE NOTE:

We have Zero Tolerance to Spam. Chessy Comments and Comments with Links will be deleted immediately upon our review.

แสดงความคิดเห็น